The Report

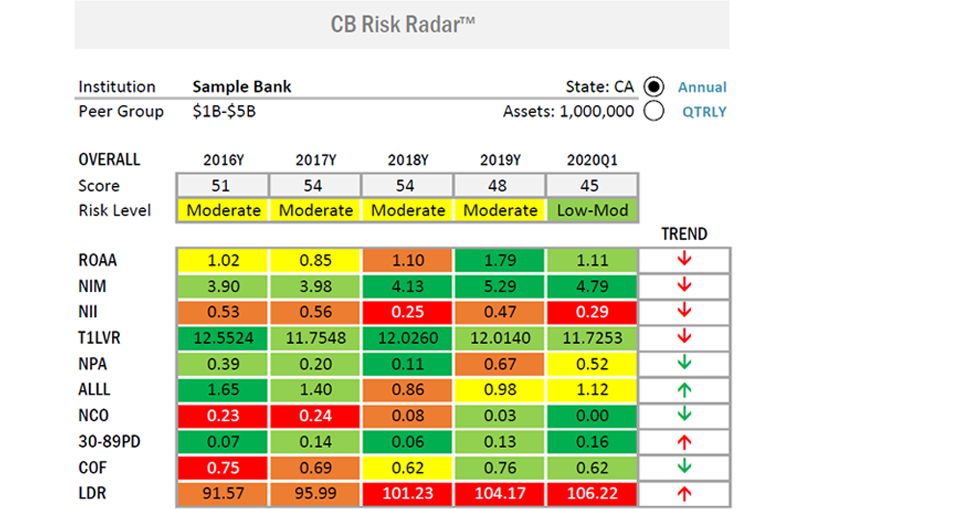

The CB Risk Radar™ is a scorecard we developed to quantitatively gauge a bank’s risk profile. A bank’s data is compared to their asset-based peer group to illustrate amount of risk in a relative manner. Multiple time periods illustrate key risk trends. This provides a solid representation of a bank’s overall risk profile by viewing and aggregating key risk indicators related to earnings, capital, credit quality, interest rate & liquidity risks.

What You Get

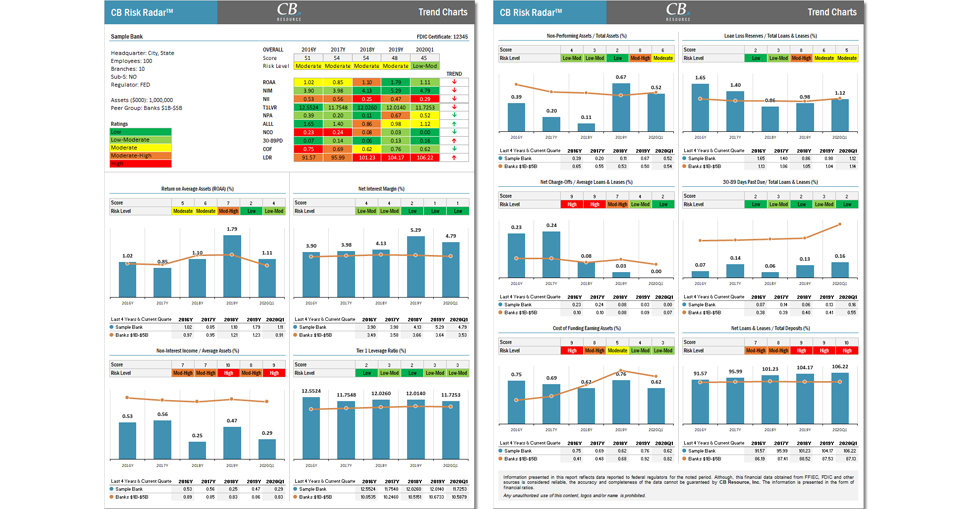

- Two-page report with summary chart and graph for each KRI

- Data and trend analysis for most recent quarter and previous 4 years

- Key Risk Indicators featured: ROAA, Net Interest Margin, Non-Interest Income, Leverage Ratio, Non-Performing Assets, ALLL, Net Charge Offs, 30-89 Days Past Due, Cost of Funding Earning Assets, and Loan to Deposit Ratio

- Relative peer comparison based on asset size group

- Overall score and risk rating for bank

- Conveniently emailed to you